Mitigate risks that may emerge from a merger or acquisition

Financial and commercial due diligence are often the focus when it comes to any kind of merger or acquisition. In regulated markets, however, it’s even more crucial that both purchasers and vendors carry out regulatory due diligence before any deal is agreed.

Undertaking a regulatory due diligence review can help the purchaser avoid buying into unknown conduct risks or legacy issues associated with the ‘back-book’. The process can also help the vendor evidence value or identify unknown issues before going to market.

It is important to have a thorough understanding of regulators’ expectations and their shifting area of interest. That’s where we come in.

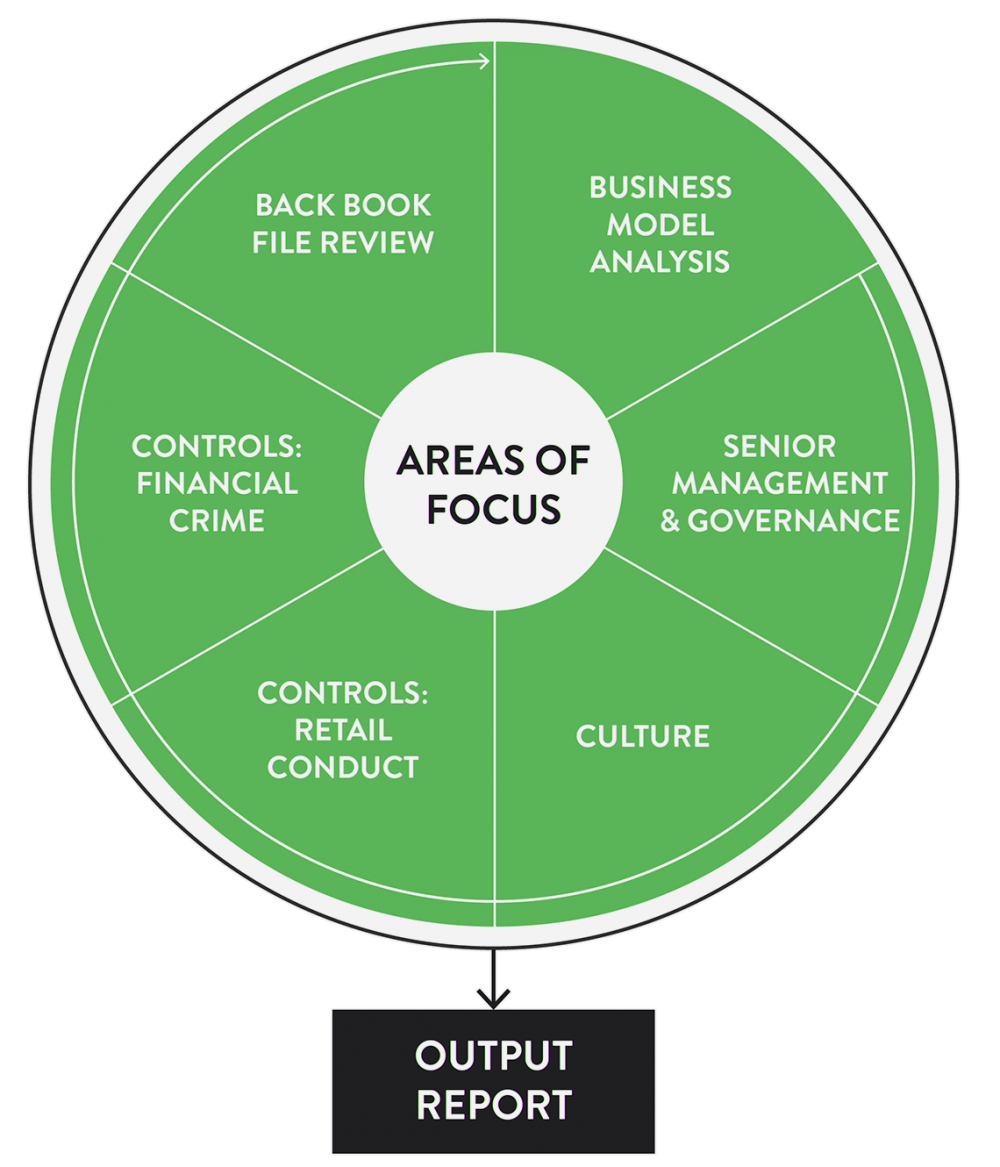

Huntswood’s regulatory experts will be able to support your firm by providing an assessment of regulatory risks, determine the effectiveness of your firm’s internal controls and carry out an impact assessment on any risks that may emerge from a merger or acquisition. We’ll also help you improve the quality of your management information so that all parties involved have a clear view going forward.

Our due diligence model follows the end-to-end journey of an M&A deal and is adaptable to suit your firm’s needs.

Why Huntswood

- Gain robust regulatory assurance ahead of undertaking any merger or acquisition from a team of ex-regulators and experts in their field

- We’ll be on hand to ensure that, as an acquiring firm, you do not ‘buy into’ excess regulatory risk or past issues

- We’ll also ensure that you, as a vendor, provide a clear view of any risks and how to mitigate them ahead of sale and provide assurance that the deal is great value for money. Basically, we can help move the sale process along

Related pages

Senior Managers and Certification Regime

Helping firms to interpret and embed the SM&CR’s requirements effectively

Regulatory Health Checks

Ensure your operations remain compliant and deliver good outcomes for customers

Regulatory Risk and Assurance

Helping firms mitigate compliance risk while delivering good business and customer outcomes

Mitigating Risk

Risk is always there, how you effectively manage it in your business can be the difference between success and failure.

Latest Insights

Remediation

Motor Finance – Planning Ahead

A strategic blueprint for firms responding to complaints about discretionary commission arrangements.

Customer Servicing

Consumer Duty Day 2 – Good Outcomes for Vulnerable Customers

Delivering good outcomes for vulnerable customers is not simple and requires careful consideration across a range of areas.

Customer Servicing

The three R's of clear communication

Critical considerations for firms implementing changes to their communications in line with Consumer Duty.

Complaints

Motor finance – some practical challenges

The immediate practical challenges arising from the FCA’s recent motor finance commission announcement

SIGN UP FOR REGULAR INSIGHT

Keeping up-to-date with the latest industry topics and regulatory issues can be quite time-consuming!

Thankfully, our regulatory experts are here to help you stay on top of it all. Fill in the short form below to receive a monthly round-up of our insight, news and analysis.