Doing what’s right for the customers

Regulators across just about every sector we are engaged in have made ‘vulnerable customer’ policy a priority and will continue to do so for the foreseeable future.

Ensuring that customers in vulnerable circumstances are protected and receive fair outcomes is not just a regulatory requirement, it’s a moral duty for firms supplying essential products and services. Doing your part for vulnerable customers also leads to continued customer advocacy and loyalty among customers.

But identifying customers in vulnerable circumstances – and taking action to support them – is not a simple matter. “Vulnerability” can be a permanent state (resulting from disability, for example) but it can also be a temporary state caused by one of life’s many challenges.

A proven track record

Huntswood has a long history in delivering projects that deliver fair outcomes for vulnerable customers. Our advisory expertise and operational finesse allow us to ensure that all of your customers receive the best service possible.

Huntswood can help your firm write the policies and governance strategy that underpin your approach to supporting customers in vulnerable circumstances. We then embed the systems and resource needed to monitor, respond to and protect those who most need it.

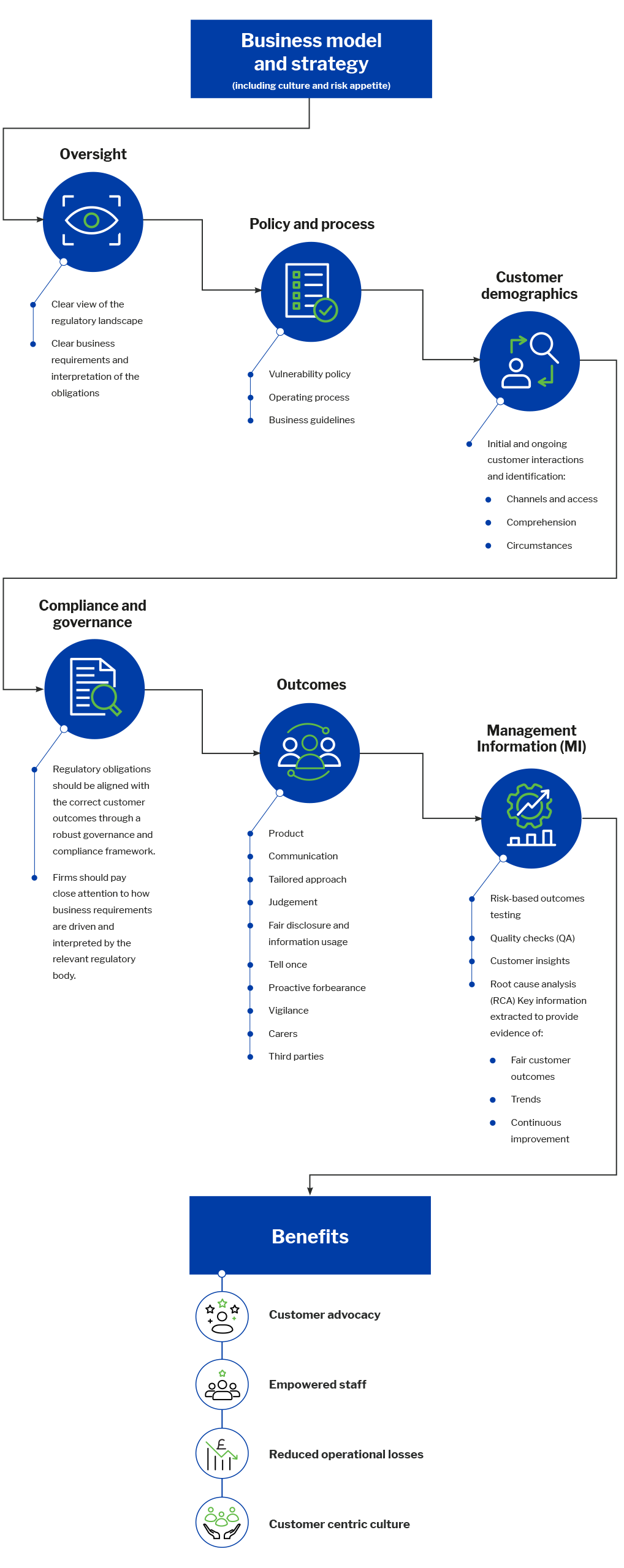

Vulnerability framework

Firms must ask themselves how they will ensure effective delivery of suitable outcomes in a way that engages senior management, is aligned to strategy, culture and business model, is tailored to the firm’s customers and ensures that the key benefits are delivered.

We can provide assurance on your firm’s vulnerability framework, and even support in the creation of a whole new strategy that will be fit-for-purpose for years to come.

Fair treatment of customers in vulnerable circumstances

Improve the way your firm handles customer vulnerability

Latest insights