Motor Finance Remediation

Making things right for your business and your customers

Driving better outcomes in motor finance remediation

At Huntswood, we understand the unique challenges facing motor finance providers in today’s regulatory and consumer landscape.

Our proven remediation approach is designed to help you navigate complex issues—from Consumer Duty compliance to affordability assessments and historic lending practices—with confidence and agility.

Our range of services

We offer a comprehensive suite of services to support motor finance firms across the full remediation lifecycle:

Full-service remediation

- End-to-end delivery from issue analysis to customer redress and closure

- SME-supported design and execution

- Regulatory engagement and reporting

Resource augmentation

- Rapid deployment of skilled interim and permanent staff

- Access to 20,000+ vetted professionals

- Flexible models: on-site, remote, or hybrid

Regulatory support

- Conduct risk and Consumer Duty expertise

- Root cause analysis and forward-fix strategies

- Regulator interaction and assurance reviews

Technical project setup

- Case management systems and tooling accelerators

- Data orchestration, cleansing, and transformation

- MI, QA, and calculator design with actuarial input

Recruitment services

- Sourcing of contract and permanent staff for regulated roles

- Deep market knowledge and exclusive access to top talent

- Seamless onboarding and vetting

Our four-pillar remediation framework

1. Understand the issue & forward-fix

- Root cause analysis of motor finance complaints and conduct risks

- Regulatory and precedent review specific to motor lending

- Customer experience and vulnerability assessment

2. Population identification & interrogation

- Identification of affected customer cohorts (e.g. DCA, Commission level, unfairness indicators)

- Data cleansing and transformation of legacy motor finance systems

- Risk-based segmentation for prioritised remediation

3. Remediation design

- Redress strategy tailored to motor finance products

- SOPs for affordability, commission disclosure, and mis-selling

- Customer engagement templates and multi-channel outreach

- Actuarial calculator design for redress modelling

4. Remediation delivery & closure

- Deployment of trained case handlers and QA specialists

- Governance setup with MI, KPIs, and closure reporting

- Digital and postal communication strategies

- • Transition to BAU with full documentation and audit trail

Case study

Motor finance consumer duty remediation

We supported a large motor finance firm in designing and piloting a full remediation framework following a Consumer Duty assurance review.

Our work included:

Identify

Cohort identification and treatment strategy

Design

Customer communication design

Analysis

MI and QA build

Support

SME oversight and pilot refinement

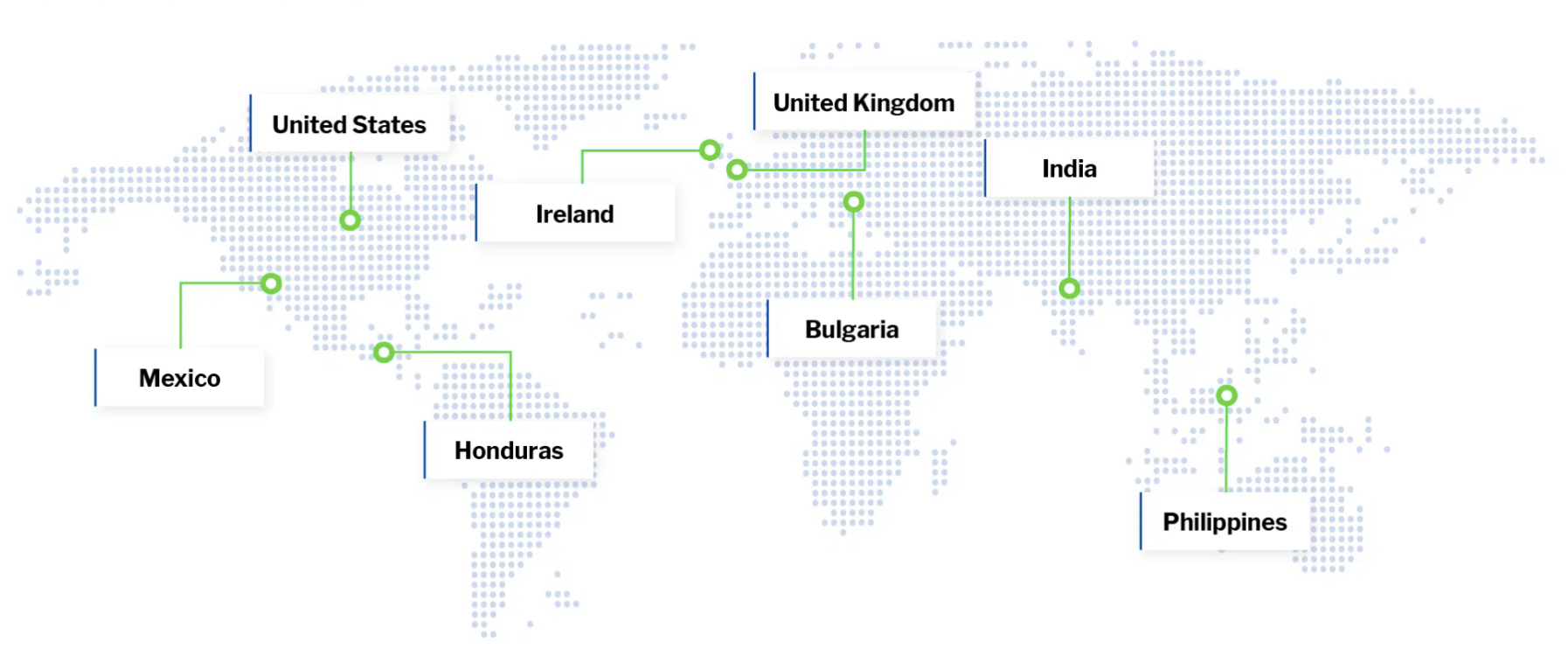

Global reach, local expertise

Huntswood operates across a network of global delivery centres, enabling us to provide scalable, cost-effective remediation solutions tailored to the motor finance sector.

Delivery locations

We have established operations in:

- UK – 3 centres of excellence and work-from-home models, ensuring flexibility and resilience across all engagements.

- South Africa – 5 offices delivering empathetic customer service

- India – Specialising in automation and

Cost-effective solutions

Our remediation expertise allows us to:

- Reduce operational costs without compromising quality

- Deliver high-volume remediation at pace

- Provide multilingual support for diverse customer bases

- Maintain regulatory compliance through centralised oversight and governance

Expertise at scale

- Access to 20,000+ vetted professionals globally

- Seamless integration with UK-based advisory and project management teams

Whether you need a full-service onshore, offshore operation or a hybrid model combining UK and international resources, Huntswood delivers the right people, processes, and technology – wherever and however you need them.

Speak to our experts to find out more about our solutions

Driving compliance excellence in Motor Finance

The Huntswood difference

We are the ‘go-to’ partner for regulated firms requiring enhanced operational resilience, with extensive experience in supporting businesses manage the impacts both during and after critical incidents.

Our support doesn’t end there; our experience means we are well-placed to proactively evaluate your operational resilience plans and help you prepare effectively, so if the worst happens, you know you will be able to act fast, protecting your firm from excessive customer, regulatory or reputational risks.

- End-to-end delivery from issue analysis to customer redress and closure

- SME-supported design and execution

- Regulatory engagement and reporting

- Rapid deployment of skilled interim and permanent staff

- Access to 20,000+ vetted professionals

- Flexible models: on-site, remote, or hybrid

- Conduct risk and Consumer Duty expertise

- Root cause analysis and forward-fix strategies

- Regulator interaction and assurance reviews

- Case management systems and tooling accelerators

- Data orchestration, cleansing, and transformation

- MI, QA, and calculator design with actuarial input

- Sourcing of contract and permanent staff for regulated roles

- Deep market knowledge and exclusive access to top talent

- Seamless onboarding and vetting aligned to your standards