SCENARIO:

Our client was experiencing a significant spike in complaints around packaged bank accounts (PBA) due, in part, to increased claims management company (CMC) activity. Huntswood was already engaged in handling a portion of the bank’s PBA complaints, but was required to react to the large uplift in activity by providing a team to handle the majority of incoming cases.

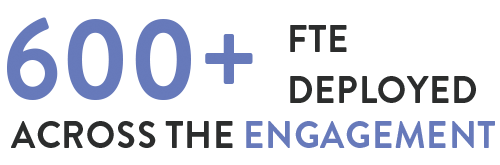

The extent of CMC activity meant that Huntswood was required to flex its operation significantly to accommodate the increased workload, this eventually brought our total deployed FTE to over 600.

Huntswood was one of three suppliers on the engagement. Our operational and learning experts helped upskill other suppliers’ teams, supporting the client to achieve its desired outcomes. During the engagement, the client moved away from the other suppliers, and by Q2 2019, Huntswood had backfilled the other suppliers’ roles and was the sole supplier of the service.

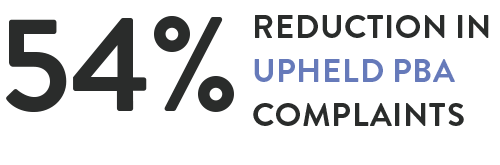

Before Huntswood’s involvement, the client’s uphold rate on PBA complaints was close to 70%. Huntswood’s regulatory experts complemented our quality delivery by working with the client to find ways of reducing upholds while maintaining fair outcomes. Today, via process policy changes, uphold rates stand at 32%.

At the client’s request, Huntswood performed a back book review of 30,000 previously worked complaints. This was to provide assurance over the outcomes provided by what was, by then, a five year engagement. We remain engaged on the project, with 360+ FTE deployed.